PASS YOUR EXAM IN THE FIRST TRY WITH THE FOLLOWING REASONS:

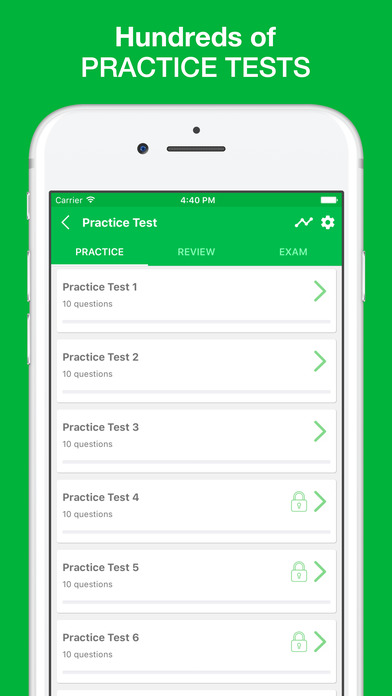

+) BREAK hundreds of practice questions and flashcards INTO small sets

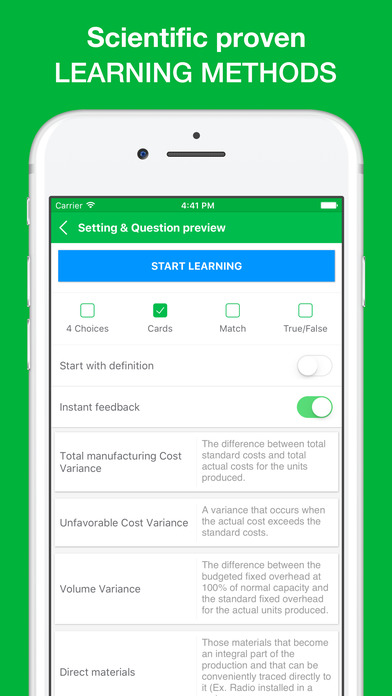

+) MASTER each study set effortlessly by many scientific proven methods: Multiple Choice, True/False, Matching, etc

+) TRACK your progress on every practice test and exam topic: MEASURE your weakest and strongest categories

+) SEPARATE hardest questions and cards into one group to study more effectively

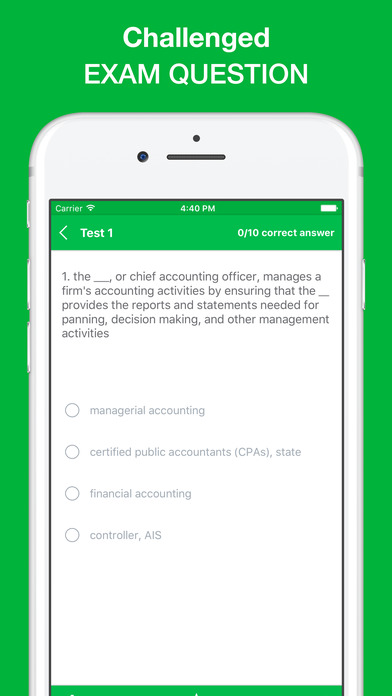

+) CHALLENGE yourself by EXAM SIMULATOR with timebox and an intelligent grading system

Get the FREE app now to access:

+) Hundreds of free practice questions and flashcards

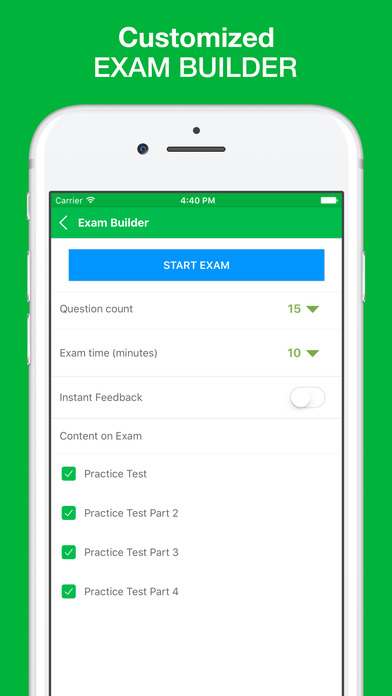

+) 5 Free Exam Builder with detailed explanation and history

+) Learn more efficiently with the Matching Game

Unlock the Premium Version to get access to:

*) ALL the Exam Questions

*) Hundreds of flashcards

*) Lifetime access to the Exam Builder

*) Lifetime support and updates

We Guarantee that using this app will help you get better understanding, more practical cases, less preparation time & a better score in the exam.

Regulation (4.0 hours): (REG) – This section covers knowledge of ethics and professional responsibility, business law, Federal tax procedures and accounting issues, Federal taxation of property transactions, Federal taxation – individuals, and Federal taxation – entities.

Regulation

15-19% ethical and legal responsibilities

17-21% business law

11-15% federal tax process

12-16% gain and loss taxation

13-19% individual tax

18-24% taxation of entities

Disclaimer:

This applications is just an excellent tool for self study and exam preparation. Its not affiliated with or endorsed by any testing organization, certificate, test name or trademark.